Little Known Questions About Financial Advisor Fees.

Wiki Article

Financial Advisor Fundamentals Explained

Table of ContentsFinancial Advisor Near Me Fundamentals ExplainedFinancial Advisor Job Description for DummiesThe 10-Minute Rule for Advisors Financial Asheboro NcThe Best Guide To Financial Advisor

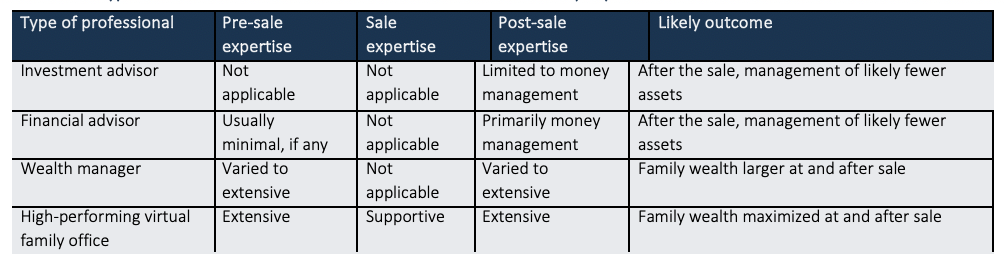

There are a number of types of financial advisors out there, each with differing credentials, specializeds, and degrees of responsibility. And when you're on the search for a professional fit to your demands, it's not unusual to ask, "How do I know which monetary expert is best for me?" The solution starts with an honest bookkeeping of your requirements as well as a little of research study.That's why it's vital to research prospective consultants and also understand their qualifications before you turn over your cash. Sorts Of Financial Advisors to Think About Depending on your monetary needs, you might choose for a generalized or specialized economic expert. Knowing your options is the initial step. As you begin to study the globe of seeking out a monetary advisor that fits your requirements, you will likely be offered with lots of titles leaving you asking yourself if you are calling the appropriate person.

It is very important to note that some economic experts additionally have broker licenses (significance they can market safety and securities), however they are not only brokers. On the very same note, brokers are not all certified similarly and also are not economic advisors. This is just one of the lots of factors it is best to begin with a qualified monetary planner that can suggest you on your investments and also retirement.

Fascination About Financial Advisor Fees

Unlike financial investment advisors, brokers are not paid directly by clients, instead, they earn compensations for trading supplies as well as bonds, and also for selling mutual funds as well as other products.

You can typically tell a consultant's specialty from his or her economic certifications. For instance, a recognized estate coordinator (AEP) is a consultant that concentrates on estate planning. So when you're searching for an economic consultant, it behaves to have an idea what you desire aid with. It's also worth pointing out financial organizers. financial advisor certifications.

Much like "financial advisor," "monetary coordinator" is likewise a wide term. No matter of your specific requirements and also economic scenario, one requirements you need to highly think about is whether a potential advisor is a fiduciary.

The Ultimate Guide To Financial Advisor Job Description

To safeguard on your own from someone who is just trying to get more money from you, it's a great suggestion to seek a consultant who is registered as a fiduciary. An economic consultant that is signed up as a fiduciary is called for, by regulation, to act in the most effective passions of a customer.Fiduciaries can just advise you to make use of such items if they assume it's in fact financial advisor assistant the ideal economic decision for you to do so. The United State Stocks as well as Exchange Commission (SEC) regulates fiduciaries. Fiduciaries who stop working to act in a customer's ideal interests can be struck with penalties and/or imprisonment of as much as 10 years.

Nevertheless, that isn't because any individual can get them. Getting either accreditation requires someone to go with a variety of classes and examinations, in enhancement to gaining a set amount of hands-on experience. The outcome of the accreditation procedure is that CFPs and Ch, FCs are well-versed in topics throughout the area of individual financing.

The fee might be 1. Fees normally lower as AUM rises. The choice is a fee-based expert.

An Unbiased View of Advisor Financial Services

click over here

For instance, an advisor's administration fee may or might not cover the costs connected with trading safety and securities. Some advisors additionally charge an established cost per deal. Ensure you understand any type of and also all of the fees a consultant charges. You do not intend to place every one of your cash under their control only to take care of covert surprises in the future.

This is a service where the expert will certainly pack all account monitoring prices, consisting of trading fees and also expenditure proportions, right into one thorough fee. Because this fee covers a lot more, it is generally greater than a fee that just consists of monitoring as well as leaves out points like trading prices. additional resources Wrap charges are appealing for their simpleness however additionally aren't worth the expense for everybody.

They likewise charge costs that are well below the consultant fees from typical, human advisors. While a conventional consultant usually charges a cost in between 1% and also 2% of AUM, the charge for a robo-advisor is normally 0. 5% or less. The large compromise with a robo-advisor is that you usually don't have the capacity to speak with a human expert.

Report this wiki page